A trust fund is a legal entity that holds property or assets on behalf of another person, group or organization, that is managed by a trustee. A trustee manages/holds the assets (and/or benefits of these assets) as instructed by the trust directives, until the appointed time that they are to be transferred to the beneficiary. Besides finances, a trust can also contain real estate, stocks, a business or any combination of assets.

Trust funds provide more control and specific instruction than a will does. Upon death, a will becomes public record and there’s no guarantee your wishes will be met. With a trust fund, only the trustee(s) and beneficiaries know the contents and conditions of the fund, so a third party contesting it is highly unlikely. Most people prefer privacy, and to keep government and others out of family matters.

There are over 50 types of trusts, so it is very important to have professional legal help, and to ensure the wording is maintained as laws change. Some trusts can protect assets against legal action and provide tax benefits, protecting your beneficiaries against creditors, lawsuits and divorce claims. You should always ask your trust attorney what benefits your trust has.

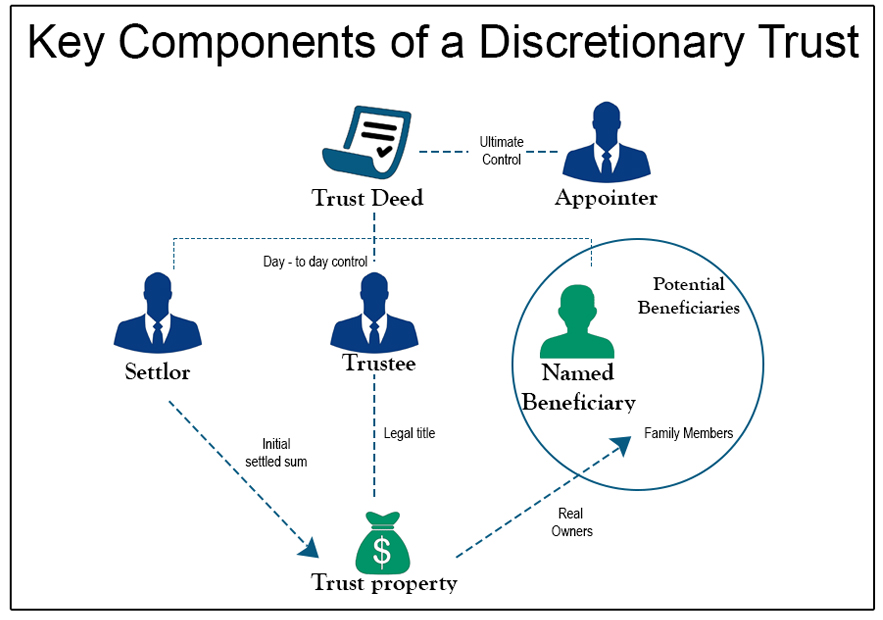

A trust fund is structured around three parties: the grantor, trustee(s) and beneficiary(s). The grantor establishes the trust and places their assets in to it. The trustee is the person or institution that holds and manages it. Once the set conditions are met, the assets and benefits will be granted to the beneficiaries. The grantor provides instructions, within the trust, on how and when the assets should be managed and distributed, such as if the beneficiary is to receive a lump sum or pay out stream, or if the beneficiary must reach a certain age before benefits can be received. Specific instructions can include things like only going towards college tuition or specific uses, such as a down payment on a home, etc.

Three parties for a trust.

- Grantor

- Trustee(s)

- Beneficiary

Protect your desires

- Avoid probate court

- Leave special detailed instructions

- Your exact wishes are followed

Another benefit of a trust that a “will” cannot provide, is in the event of incapacitation. A “will” only goes into effect upon death, so if the grantor were in a coma, it would provide no legal directive. A Trust however, once established, is it’s own entity, regardless of the state (alive and well, incapacitated, or deceased) of the grantor. The wishes of the grantor can also “live on” for many decades after their death, keeping the trust instruction intact. A trust can have virtually any terms that a grantor wishes.

A trust is funded first by establishing the terms, then the particular assets are re-titled to be the property of the trust. If the assets are in any other title, other than the name of the trust, the trustee has no right to distribute or manage the asset, and these non-trust titled assets, would then go to probate, as if the trust did not exist.

The benefits of a trust are maintaining control of the grantors assets (within the trust) in event of incapacitation, and avoiding the probate process, as the assets are already legally “spoken for”. The trust owns the assets, not an individual. A trust also helps keep family information private and cannot be contested the same way a “will” can. Along with these benefits, certain trusts can allow the beneficiaries to keep assets within it, protecting them from claims that may come from lawsuits, creditors, divorce, etc.